The Chicago Method is also known as the Venture capital method. It is a valuation approach for businesses and is used by Private Equity and Venture Capital Investors. The Chicago method merges the elements of the Discounted Cash Flow and a Multiple-based valuation. Developed by and named after the First Chicago bank, the Chicago method of valuation was initially discussed in 1987. The Chicago bank is the predecessor of the Firms GTCR and Madison Dearborn Partners.

Startup Valuation:

A Startup means a newly incorporated company which is formed with purpose of developing unique products and to develop the same the entrepreneurs need some funding which can be completed by initial funding or seed funding round. To raise the funding, the owner needs to know the value of his business, further investor also needs to know the valuation of the entity in which he will invest the fund and will receive equity in the business against the fund given. A wrong valuation could lead to losses and unfair advantage to owner or investor.

The Startup Valuation should not be based on guesses and should be based on related startups in same niche.

There are various methods for valuation of a Startup, Chicago Method of Valuation is one of those methods.

What is Chicago Method of Valuation?

The Chicago Method of Valuation is the best method of Valuation for Startup Companies. This method of Valuation is the combination of various dynamic growth possibilities of Company.

This method basically covers all possible situation of Company’s growth. This method consider the possibility of Failure, Survival and Success in the Company

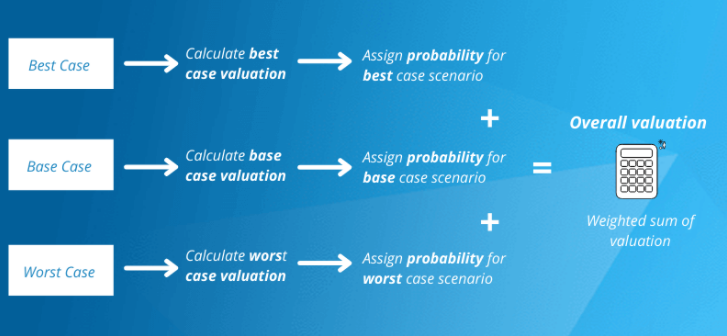

For this one should drive the three possible future scenario, keeping in mind all three possible situation i.e.

- Best Case: The situation if Company performs its best

- Base Case: When Company performs Average

- Worst Case: If Company performs worst.

Steps involved in Chicago Method of valuation:

- Estimating the future projections including its Future Income & Expenditure and Assets & Liabilities also for all 3 possible situations.

- Determine the cash flow individually for all three scenarios by adding all cash inflows and deducting all cash outflows.

- Determine the discounting factors for all cases, the discounting factors can be arrived by using following formula:

R = Wke+Wkd

Ke= Rf+(Rp*B)

Kd= Interest *(1-tax)

R = Discounting Factor

Wke = Weighted Cost of Equity

WKd = Weighted Cost of Debt

Ke = Cost of Equity

Kd= Cost of Debt

Rf = Risk free Return

Rp = Risk Premium

B = Beta

- Determine the Present Value of Cash Flow, which can be arrived by discounting the net cash flow by using the discounting factors calculated and also determine the present value of Terminal Cash flow.

- Estimate the probability of all Possibilities:

Designate the probability to all the possibilities It is not possible to be precise in every case scenario when determining the probabilities. But the overall idea here is to take drastic outcomes in the valuation process. Final and Last step is to calculate the final overall valuation by sum of weighted Valuations under all possibilities.

Elements of Chicago Methods:

- Discounted Cash flow :

Step No. 1 to 4 mentioned earlier in Chicago Methods represents the Discounted Cash flow element of Chicago Methods.

- Multi Based Valuation:

Step No. 5 and 6 mentioned earlier in Chicago Methods represents the Multi based valuation element of Chicago Methods.

Chicago Method: Why best method of Valuation for Startups?

The Startup is a Company which is newly incorporated and start its business from the very first step. A Startup Company has no historical data by help of which one can arrive the possible growth. Therefore if owner of Startup evaluate the possible growth on basis of guesses and assumptions, in that case there are high chances that estimated growth may differ from actual growth of Company.

So the best way to estimate future growth of a Startup Company is to estimate the all possibilities i.e. Best, Base and Worst Scenario and in the same way the best way to valuate the startup is to value the all possibilities of Startup. Therefore, Chicago Method of valuation is best and most suitable for Startup Valuation due to same nature and characterstics.

Pros of Chicago Method:

- This method is best used to evaluate early stage startups that have a more dynamic growth model.

- It keeps in account the all scenarios where there is a huge potential of losses and profits also.

- Every calculation is based on precise estimates of the values in the future and the cash flows.

- This method is comprehensive and detailed.

- This method is favorable to both owner and Investor.

Cons of Chicago Method:

- It is not useful for startups with no revenue.

- It can be time-consuming and very intricate.

- The freedom of considering different events adds complexity to this method.

- This method applies to companies that are in an industry where there is insufficient data. If there is sufficient information, investors will use other methods.

- To evaluate a startup correctly, one needs to have detailed knowledge about the business and the estimates. Only then can one get an accurate valuation.

For any query or any other information please contact author at jassociates.cs.com or @valuationmart